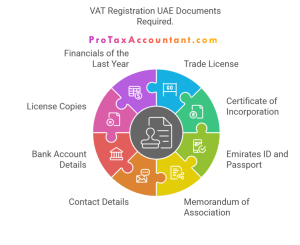

Core requirements typically embody a replica of the company’s commerce license, passport and Emirates ID copies for the homeowners, and proof of authorisation for the signatory. You may also need to offer firm bank account details and a clear description of your corporation activities. The FTA makes use of this paperwork to verify your business’s identity and eligibility. The FTA is not going to full your deregistration until you file the ultimate return and settle all amounts owed. To guarantee accuracy and timely submission, use TaxReady.ae’s VAT return submitting providers.

Based on this data, people can decide whether or not to purchase something. VAT, as a common consumption tax, will apply to the majority of transactions in goods and services. VAT (Value Added Tax) in the UAE is an indirect tax on the consumption of products and providers, launched on January 1, 2018, and picked up at each stage of the provision chain. This initiative is grounded in Federal Decree-Law No. 16 of 2024, which amended the VAT Legislation to legally recognize e-invoices for VAT reporting and input tax recovery, efficient from November 2024. Residents should register through the tenant portal, receive an authorised PIN by e mail, and activate their vehicle within the PARKONIC+ app.

Conclusion: Start Smart With Vat Registration Uae

- You don’t charge VAT, and you can’t reclaim VAT on expenses tied to these actions.

- For companies that don’t meet this degree, voluntary registration is an choice if their taxable provides or expenses exceeded AED 187,500 in the last 12 months.

- Credit that remain unclaimed past this window might lapse completely.

- We handle the complete course of for you, together with document submission and TRN issuance.

- It’s frequent for corporations in all emirates to hunt specialised help.

FTA VAT portal UAE can solve all crises in the method in which of registration exactly, and companies never worry about how to register for VAT in UAE. The Accountax is top-grade members are advantageous for all enterprises that are concerned in the registration methodology. The UAE’s VAT law is federal, so all Emirates comply with the identical rules. Whether Or Not you use in Dubai, Sharjah, Abu Dhabi, or another Emirate (mainland or qualifying free zone), you register on the FTA portal and apply the identical thresholds. Local nuances only arise in how businesses organise their accounts or which PRO services they use, but the core VAT registration process in UAE is similar across the country. Beyond registration itself, the FTA additionally imposes penalties for late submitting or fee of VAT, however these are separate issues covered under VAT returns.

Do Free Zone Companies Must Charge Vat?

The UAE launched VAT as part of its financial diversification technique, aligning with other Gulf Cooperation Council (GCC) countries. The standard VAT price stands at 5%, making it some of the aggressive rates globally. This relatively low rate reflects the UAE’s dedication to sustaining its place as a business-friendly jurisdiction while generating sustainable income streams. We don’t simply register your small business, we maintain it protected, ready, and completely aligned with VAT requirements in Dubai from day one. The course of includes submitting Kind VAT311, together with supporting documentation. You don’t charge VAT, and you can’t reclaim VAT on expenses tied to these activities.

Step 3: Fill Out Enterprise And Financial Particulars

Similarly, a enterprise may register voluntarily if their bills exceed the voluntary registration threshold. This latter alternative to register voluntarily is designed to allow start-up companies with no turnover to register for VAT. In the UAE, necessary registration is required if the worth of your taxable supplies exceeded AED 375,000 over the earlier 12 months, or if you expect it to in the subsequent 30 days. For businesses that don’t meet this level, voluntary registration is an choice if their taxable supplies or bills exceeded AED 187,500 within the final 12 months.

Whether you’re a longtime business owner or simply beginning out, understanding VAT registration in UAE is crucial to navigating the country’s enterprise panorama successfully. After analyzing all provided knowledge authorities will decide clearance. The VAT registration is free, however for attested paper candidates will have to bear a payment company registration in uae online that is AED 250.

The FTA then prints and sends the certificate to your registered handle. Processing times may differ based mostly on software completeness, enterprise complexity, and present FTA workload. Businesses should plan accordingly and submit applications nicely upfront of obligatory registration deadlines. Sure, so long as the expenses relate to taxable business activities, and also you hold valid tax invoices. When setting costs, businesses should decide whether or not to display VAT-inclusive or VAT-exclusive amounts.

VAT returns are typically submitted quarterly by way of the Federal Tax Authority’s online portal. Every return must precisely mirror the VAT charged on gross sales and the VAT paid on purchases, permitting for correct calculation of tax due or reclaimable. Companies must register for VAT if their taxable provides and imports exceed AED 375,000 yearly. Voluntary registration is feasible if the turnover is below this threshold however above AED 187,500.

All VAT-registered businesses, notably those operating in buying and selling, import/export, building, real property, and high-volume procurement sectors. All UAE company tax registrants, together with mainland and free zone firms, SMEs, holding firms, multinational teams, and founders with cross-border operations. Beneath, we break down the most important corporate tax, VAT, and procedural tax changes coming into force in 2026 — and what they imply in practice for companies working in or coming into the UAE. After deregistration, you can not claim enter VAT on enterprise purchases. This change will increase your efficient cost for VAT bearing expenses, which can affect profitability relying on your price structure. Consider timing main purchases before deregistration to maximize input VAT restoration on planned capital expenditure or vital inventory replenishment.

0 Comments